Key takeaways

- DIY rental operators face challenges in maintenance, renter management, lease terms, rent collection, damage protection, and eviction risks.

- Encourage renters to troubleshoot, establish maintenance communication boundaries, and focus on long-term retention. Use professional networks for referrals.

- Provide clear violation notices and use tailored lease agreements.

- Enforce late fee penalties, send rent reminders, and use electronic payment methods.

- Ensure security deposits, know state laws, carry out property inspections, and keep detailed rent records for damage and eviction issues.

Many people believe that owning a rental property allows you to sit back and watch the monthly checks roll in. For many homeowners, however, the journey of self-managing their rental properties is filled with unexpected challenges.

We’ve conducted a survey that highlights property owners’ primary concerns when self-managing their properties. Let’s dive into these issues and provide some actionable solutions for each.

Tackling property maintenance

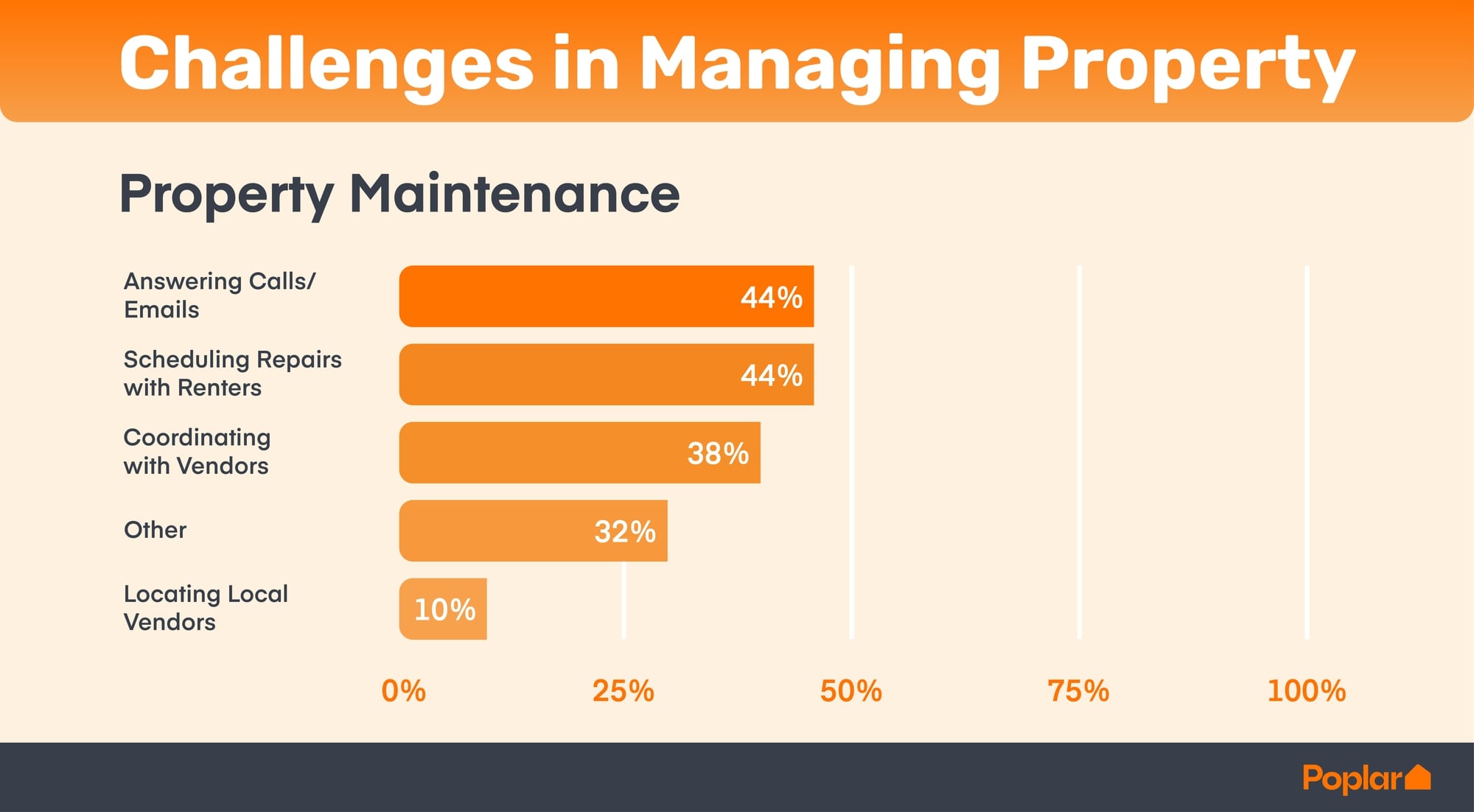

A staggering 94.2% of homeowners in our survey express their concerns about property maintenance, and it’s easy to understand why. At Poplar Homes, one of the main reasons homeowners reach out to us is to navigate the intricate maze of maintenance during tenancy.

Nearly half (44%) of the respondents find the responsibilities that come with being a property concierge — such as handling maintenance-related calls or emails — to be particularly daunting. This becomes even more challenging for those balancing full-time jobs or other commitments. Here’s a deeper dive into our findings.

To address or avoid these problems, try these solutions:

- Help renters troubleshoot issues first: Start by helping renters troubleshoot common problems themselves. Offering how-to videos or step-by-step guidance over the phone can mitigate unnecessary maintenance expenses and empower your renters at the same time.

- Set boundaries for maintenance calls: Clearly specify in the lease agreement that maintenance-related communication should be restricted to business hours, except for emergencies. Offer a tiered list categorizing repairs as a high, medium, or low priority to set clear expectations.

- Prioritize long-term retention: Focus on strategies that entice renters to stay for the long haul. This might involve investing in renovations or ensuring the property remains in top condition. A well-maintained property reduces frequent repairs, enhances renter comfort, and ensures a flourishing return on your investment.

- Leverage a professional network: Cultivate relationships within professional networks or tap into your homeowners’ association for reputable referrals. Networking with fellow property owners at association gatherings can also yield valuable recommendations.

By incorporating these strategies, homeowners can significantly ease the burden of property maintenance, ensuring both renter satisfaction and peace of mind for themselves.

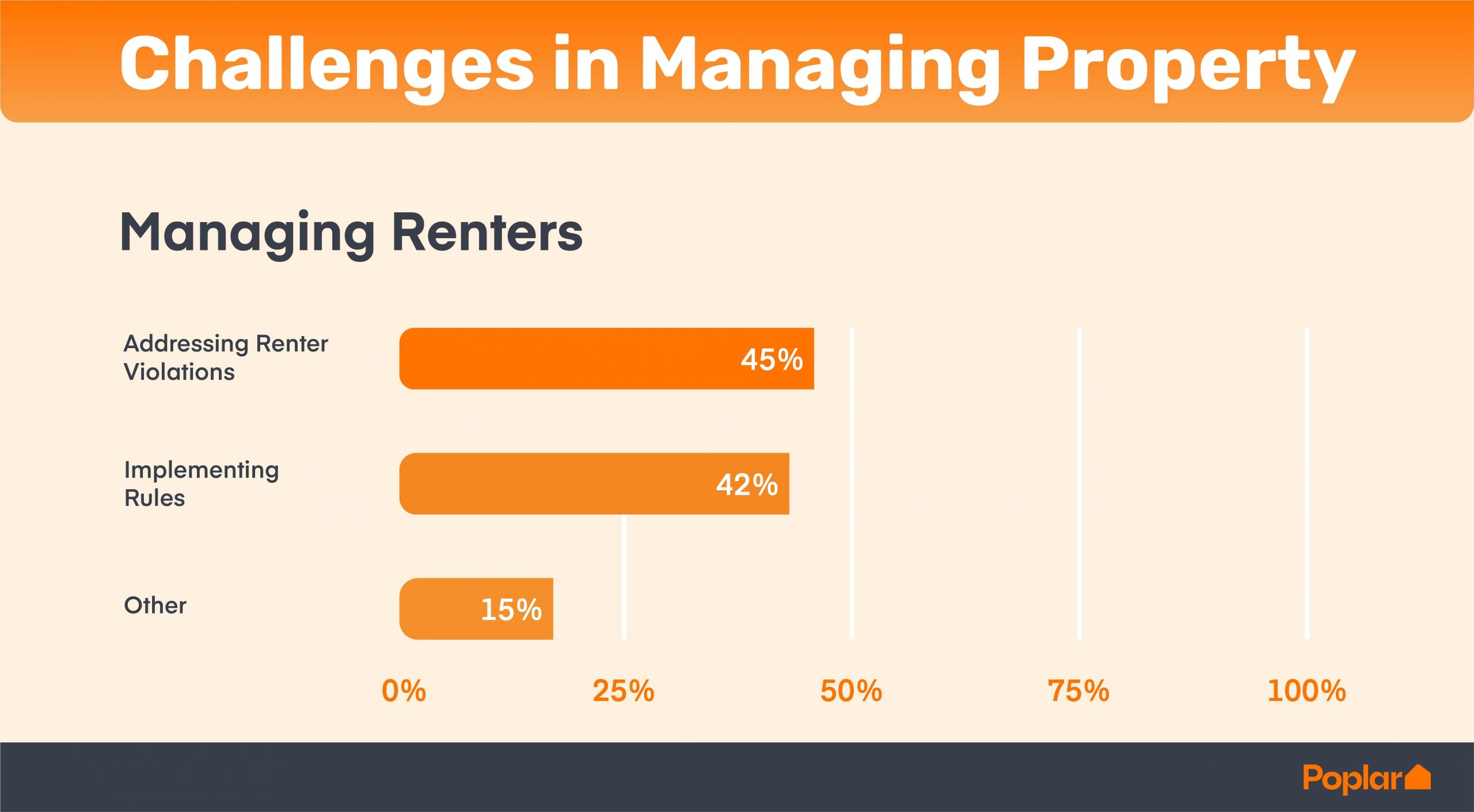

Managing renters

Managing renters involves more than just collecting monthly checks; it’s about setting clear expectations and dealing with any deviations promptly. According to our recent survey, a significant 45% of respondents feel that addressing renter violations is a stressful challenge.

Here are a couple of suggestions to handle these issues:

- Issue detailed violation notices: In instances where a renter violates lease terms, it’s crucial to communicate promptly. Send them a notice that clearly outlines the specific violations, avoiding vague or generalized statements. Familiarize yourself with your state’s regulations on serving notices to ensure you’re compliant.

- Prioritize comprehensive lease agreements: While it might be tempting to use a generic lease template, it’s far more beneficial to have a tailor-made agreement. A comprehensive lease agreement safeguards both your property and your rights. Pay meticulous attention to details, particularly concerning rent collection procedures, maintenance responsibilities, and explicit property rules.

By adopting these strategies, homeowners can not only address immediate renter-related challenges but also establish a framework for smoother renter relationships in the future.

Negotiation of lease terms

An overwhelming 48% of participants in our survey say that lease negotiations are a major challenge when it comes to leasing their property. This complexity arises from the challenge of aligning both the homeowner’s and the renter’s understanding and expectations of the lease terms.

To streamline this process and make negotiations smoother, consider these strategies:

- Be open to changes. Decide which terms of the lease you can put on the table for discussion. For instance, you could be flexible with allowing pets but not with adjusting rent. It can also help to research reasonable rates or use our rent-estimate tool, especially when discussing fees.

- Provide clear move-in documentation. This crucial document captures the state of the property before the renter’s move-in. It acts as a reference for future renters and ensures that the property’s condition is accurately documented. During this phase, it’s essential to confirm that your property is habitable, safe, and compliant with all necessary codes.

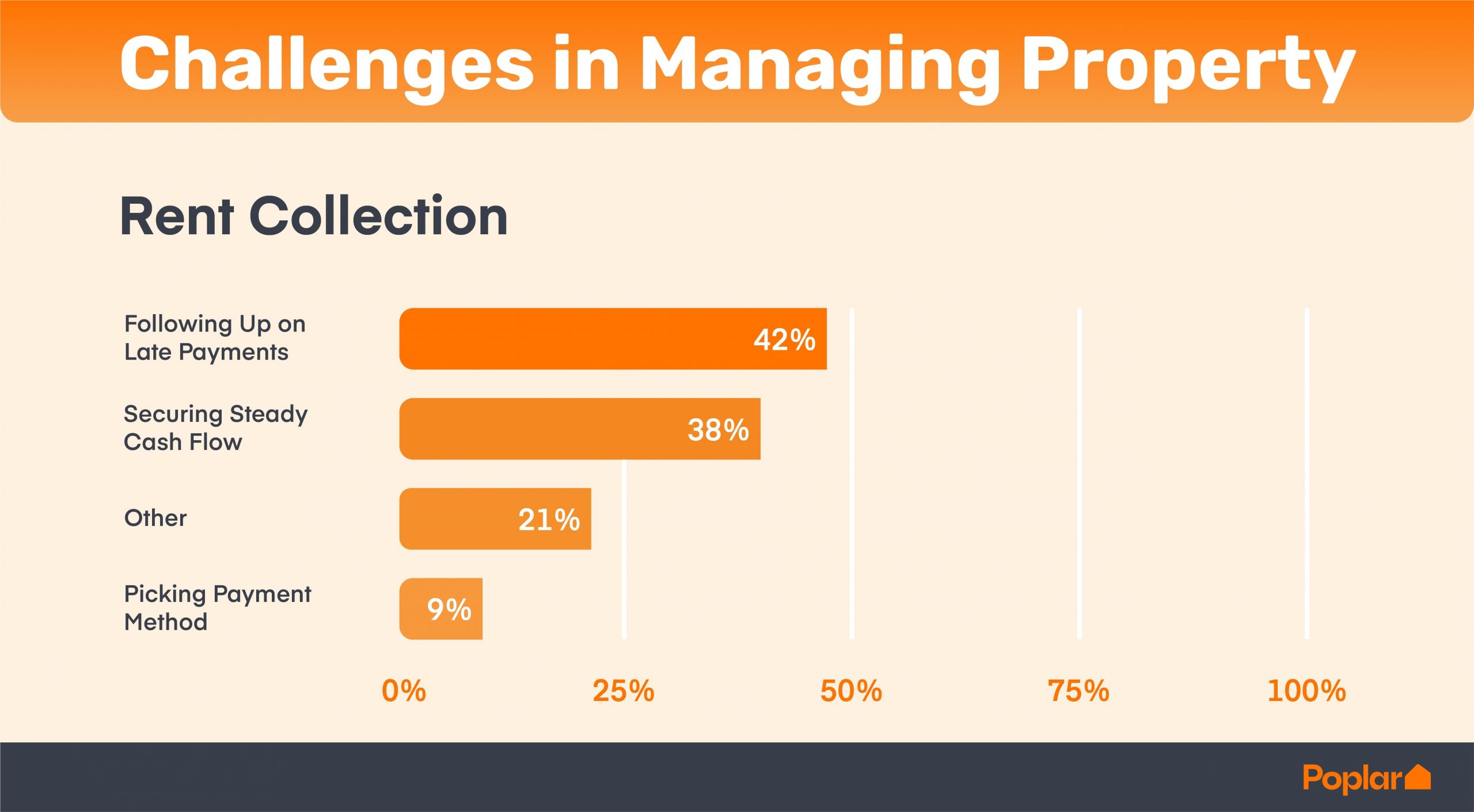

Collecting rent

One of the most challenging aspects of property management is rent collection, particularly when dealing with non-compliant renters. A telling 42% of homeowners in our survey identify that following up on late payments is one of the most challenging parts of collecting rent.

To make this process smoother, consider the following strategies:

- Highlight consequences of delays: Late payments are a headache for homeowners. To encourage timely payments, consider incorporating late fee penalties in the lease agreement. This not only motivates renters to pay promptly but also compensates you for the delay.

- Proactively remind your renters: Anticipate payment forgetfulness by sending reminders a few days ahead of the due date. Whether through email, text, or a phone call, choose a communication method that both you and your renter have agreed upon. This proactive approach helps ensure consistent cash flow and minimizes the risk of accumulating arrears.

- Embrace electronic payments: Modernizing rent collection with e-payment methods benefits both parties. It simplifies transaction records, provides undeniable proof of payments, and removes ambiguity. Moreover, with e-payments, any claims of early payments can easily be verified with transaction histories.

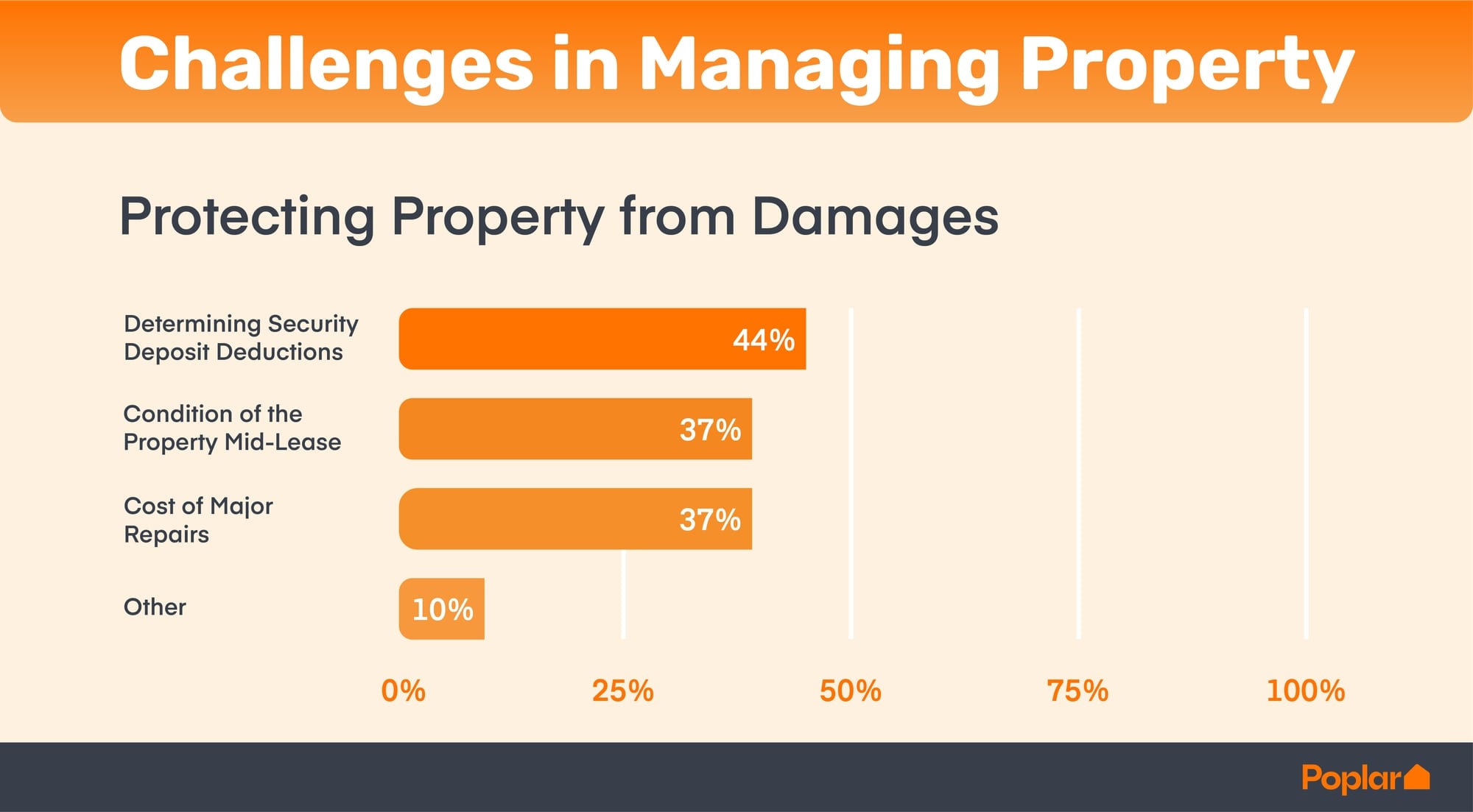

Protecting property from damage

All properties run the risk of damage. However, the level of risk often hinges on the clarity of the lease agreement, the property’s upkeep, and the diligence of the renter. According to our survey, a significant 44% of homeowners find that determining deductions from security deposits is a major challenge.

Here are ways to protect your family from damage:

- Collect a security deposit. By collecting a security deposit, you essentially incentivize your renters to maintain the property. Knowing that their money is at stake, renters are more likely to avoid actions that could lead to damages. Security deposits can cover expenses like repairs, key replacements, or unpaid rent.

- Research state laws regarding security deposits. Security deposits are often regulated by state laws. While renters should ideally receive their full deposit upon moving out, there are exceptions, such as unpaid rent or significant damages to the property. For instance, in California, homeowners are obligated to return the deposit within 21 days post move-out. It’s vital to familiarize yourself with your state’s specific regulations.

- Schedule Regular Inspections: Monitoring the property’s condition during the lease period can be challenging but is crucial. Explicitly mention in your lease the frequency of property inspections—whether it be once, twice, or thrice annually. These checks not only assess the property’s state but can also serve as a preventative maintenance measure.

Mitigating the risk of eviction

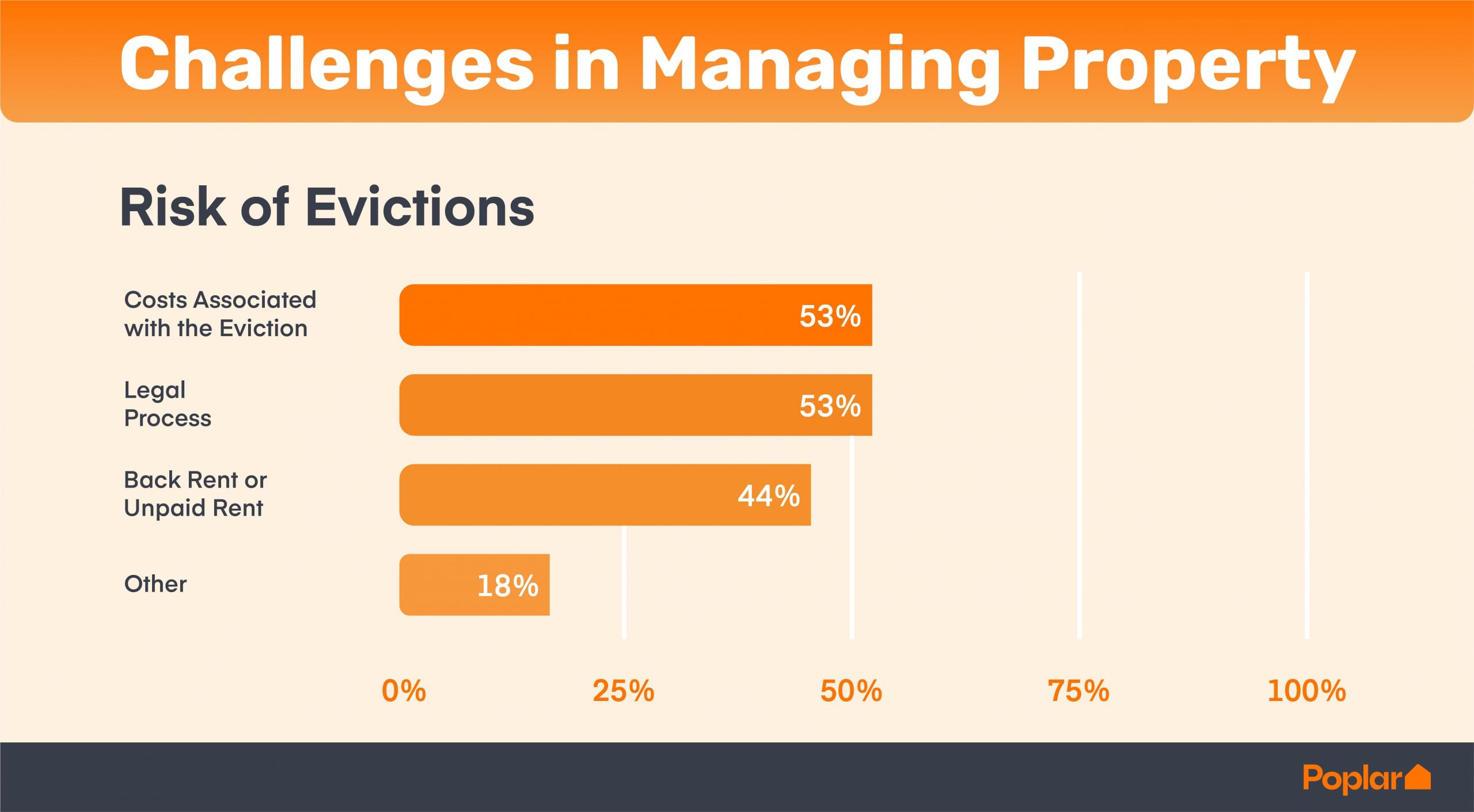

Eviction is daunting for both homeowners and renters alike. Our survey reveals that the intricacies of the legal process and the associated costs are primary concerns for homeowners dealing with evictions.

What can you do to mitigate the risk?

- Maintain a detailed record of payments due: Keeping meticulous records of unpaid rent provides a concrete foundation for any discussions with renters. In extreme scenarios where legal action becomes necessary, this record is invaluable.

- Initiate face-to-face dialogues: Engaging in direct conversations with renters can often lead to amicable resolutions, potentially bypassing the lengthy eviction process. Such interactions can gauge the renter’s commitment and help determine if they’re suited for a long-term lease.

- Compile comprehensive proof: If discrepancies about payments arise, having a robust documentation system can be a game-changer. Ensure you have accessible records, be it email conversations, e-payment receipts, or any other relevant correspondence, to substantiate your claims.

Alternatively, some property management companies like ours offer eviction coverage. We cover up to $15,000 in legal costs in the unlikely event that we have to part ways with a renter. This will help mitigate the risk of eviction and protect your hard-earned income.

Final Thoughts

Being a self-managing homeowner comes with its set of challenges, from maintenance to renter relationships. While issues are inevitable, their impact can be lessened with preparation, clear communication, and the right strategies.

Property management is as much about relationships as it is about the property itself. Building trust, setting expectations, and using the right tools can simplify the renting experience for both parties.

Challenges will arise, but their severity can be reduced. Implement the suggestions mentioned here to streamline your property management journey. You can also leverage professional help from property management companies like Poplar Homes. Doing so will free you from the mundane tasks outlined above, allowing you to focus on what truly matters.

Recent Comments