KEY TAKEAWAYS

- Short-term rentals have a higher income potential than long-term rentals. However, long-term rentals offer more income stability.

- Both short-term and long-term rentals have a high demand in Nashville.

- Short-term rentals require more time and effort to manage compared to long-term rentals.

As one of the fastest growing cities in the United States, Nashville presents an exciting opportunity for investors looking to build a profitable rental property portfolio. One of the key decisions that every investor faces is whether to invest in short-term or long-term rentals. So we’ve compared the performance of short-term and long-term rentals in Nashville to help you decide which investment strategy to go for.

Comparing and contrasting short-term and long-term rentals in Nashville

Operational cost

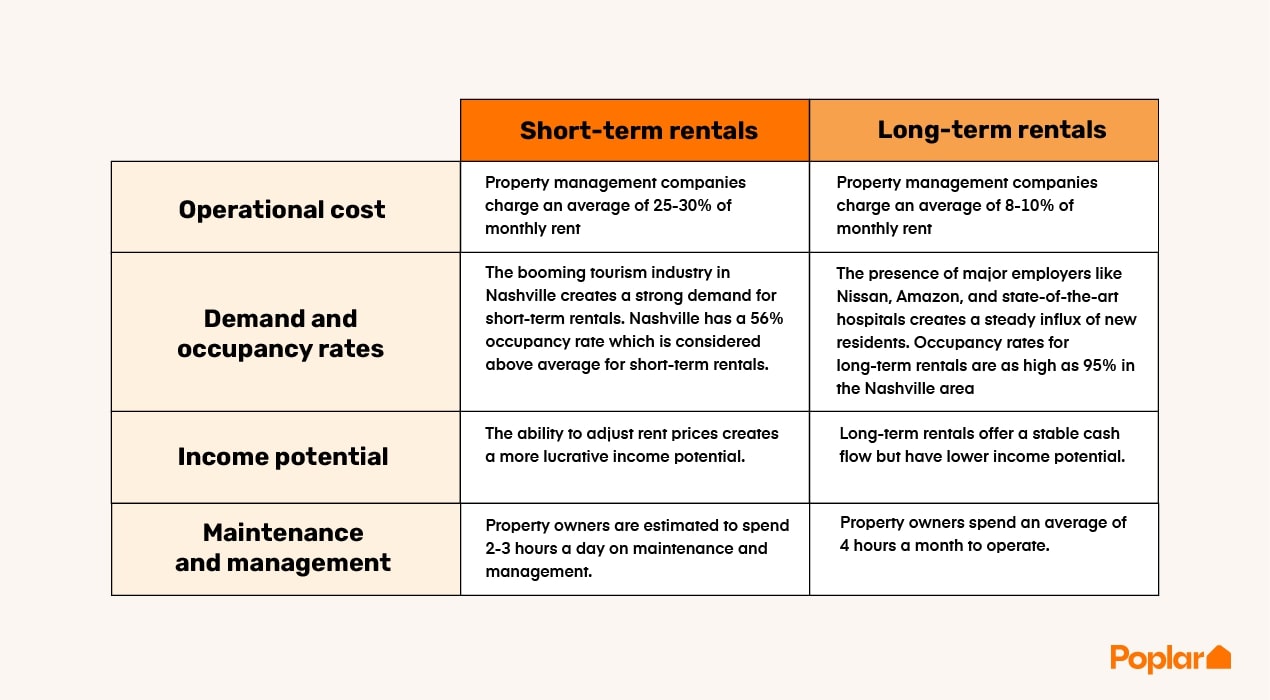

Short-term rentals generally cost more to operate compared to long-term rentals. Short-term rentals have a higher turnover rate; thus, maintenance and upkeep happen more frequently. Furthermore, you will need to improve and market your property on a regular basis to attract new renters.

Long-term rentals, on the other hand, require less maintenance because the renter will be responsible for keeping the property clean for the duration of their lease. Since residents most often stay on a yearly basis, marketing the property doesn’t happen as frequently. Because of that, property management companies charge short-term rentals 25-30% of the monthly rent as compared to an average of 8-10% for long-term rentals.

Demand and occupancy rates

True to its name, Music City draws in 14.4 million visitors every year, lured by its vibrant nightlife and world-renowned music festivals like CMA Fest and Bonnaroo. As a result, the demand for short-term rentals in Nashville is high and growing rapidly.

In fact, experts predict that Nashville’s short-term rental market will see a 10% annual increase. With a solid 56% occupancy rate, it’s no surprise that Nashville is considered one of the top cities for operating an Airbnb.

Nashville’s long-term rental market is just as hot as its short-term counterpart. The city’s population has grown by an impressive 20% over the last decade, nearly double the US average, and experts predict this trend will continue.

Nashville’s thriving job market is a major driver of this growth. The city is home to some of the biggest employers in the country, including Nissan, Amazon, and Oracle, as well as numerous health insurance, healthcare technology, and start-up companies. With so many job opportunities available, Nashville is attracting a steady stream of new residents, all of whom need a place to live. This is a major driving force behind the city’s 95.37% occupancy rate.

Income potential

When it comes to rental income, short-term rentals are generally considered more lucrative. With short-term rentals, you have the ability to adjust your rent price based on seasonality and demand.

Looking at Airbnb listings in Nashville, the average rent is around $150-250 a night. With a 56% occupancy rate, your annual revenue is somewhere between $30,660 to $51,100. Whereas with long-term rentals, the median monthly rent in Nashville is $2,209, according to Zillow’s data. Thus, your annual revenue with long-term rentals is around $26,508.

However, that’s not to say that short-term rentals are always better. Long-term rentals offer more stability and less competition than short-term rentals. Furthermore, short-term rentals are highly influenced by tourism and global events. For example, during the pandemic, Airbnb occupancy rates in Nashville dropped by 44%, whereas long-term rentals remained steady or weren’t affected as much.

Maintenance and management

Maintenance and management for long-term rentals are generally easier. Residents in long-term rentals often stay on a yearly basis or more. Thus, they will be responsible for most of the upkeep around the property. The day-to-day operations on a long-term rental only take about 4 hours a month.

Short-term rentals, on the other hand, require more time and effort. You’ll generally be responsible for cleaning the property and onboarding your renters on a regular basis. Not to mention, marketing your property and responding to queries can take up much of your time. Depending on the seasonality and location of your property, it’s estimated that short-term rental owners spend around 2-3 hours per day managing and maintaining their property.

On the flip side, getting rid of a problem tenant in long-term rentals can be difficult. Thus, following a strict tenant screening process is critical to ensuring a stable rental income for long-term properties.

Factors to consider when deciding between a short-term or long-term rental investment

When deciding between short-term and long-term rental properties in Nashville, it’s important to consider these factors:

- Purpose of the rental property: Are you looking for a property to generate passive income, or are you planning to use the property for personal use as well? If you plan to use the property for personal use, short-term rentals might be more convenient. However, if you’re solely looking for an investment property that’ll give you a stable cash flow, long-term rentals might be a better option.

- Location of the rental property: Where is your property located? Short-term rentals do well in areas close to the city’s attractions, whereas long-term rentals fare better in peaceful, residential areas that are free from noise and crowds.

- Investment goals: Are you looking to maximize your revenue, or are you looking for income stability? Short-term rentals may offer higher rental income, but long-term rentals offer more stable cash flow over the long run.

- Legal considerations: Both short-term and long-term rentals are subject to local laws and regulations. It’s important to understand the legal requirements for operating a rental property in Nashville, including zoning laws, permits, taxes, and HOA regulations.

- Risk tolerance: Short-term rentals have a higher risk of occupancy fluctuations and potential damage to the property. Long-term rentals, on the other hand, are more predictable.

Mixing it up: Building a rental portfolio in Nashville

Summing up our discussion above, both investment strategies can work great in Nashville. The booming tourism industry helps drive up the demand for short-term rentals while the entry of major employers and start-up companies keeps a steady influx of residents looking for a new home.

Thus, building a rental property portfolio with a mix of short-term and long-term rentals is a viable option for investors looking to balance lucrative income and stability.

Up next: Building a rental property portfolio: The ultimate guide

Final Thoughts

In conclusion, the decision to invest in short-term or long-term rentals in Nashville ultimately depends on various factors. While short-term rentals offer higher income potential, they also come with higher operational costs and require more management and maintenance. Long-term rentals, on the other hand, offer stability and ease of management but with lower income potential.

Regardless of which option you choose, it’s important to consider the potential impact of future regulations or market changes on the short-term and long-term rental markets in Nashville. As the city continues to grow, regulations may change, and demand may shift, potentially affecting the profitability of your investment. Thus, it’s important to stay informed and adaptable in order to maximize your returns and build a successful rental property portfolio in Nashville.

Recent Comments