A rental property comes with many perks including passive income and property value appreciation. The longer you keep a property, the more significant your potential profit can be. The downside? When it’s time to sell, your friends at the Internal Revenue Service (IRS) will take a chunky bite out of your profits by collecting a tax on the capital gains.

Luckily, there are several workarounds you can try to avoid, defer, or reduce capital gains tax on your rental property. In this article, we’ll get to the bottom of what capital gains are, how they’re being taxed, and lastly, how to pay less capital gains tax, legally, of course.

What’s a capital gain?

To start, here are some important terms to get familiar with:

- Capital assets – these are significant pieces of property like equipment, machinery, stocks, bonds, real estate, cars, and even artwork.

- Adjusted basis – the original purchase price of a capital asset, which includes other fees paid like legal fees, transfer taxes, sales commissions, and title insurance.

- Short-term capital gain – capital assets that are sold one year or less after acquisition.

- Long-term capital gain – capital assets that are sold more than a year after acquisition.

Now, going back to capital gains, this refers to the profit you earn for selling a capital asset. In simpler terms, if the selling price exceeds the adjusted basis, there’s your capital gain. There are two types: realized and unrealized. Realized is the profit made after a capital asset has been sold whereas unrealized is simply the projected profit of a capital asset to be sold at a later time.

How does capital gains tax work?

There are two ways the IRS is taxing capital gains on the federal level. It depends on whether the property falls under the short-term or long-term capital gain bracket.

For short-term gains, the ordinary income tax bracket applies:

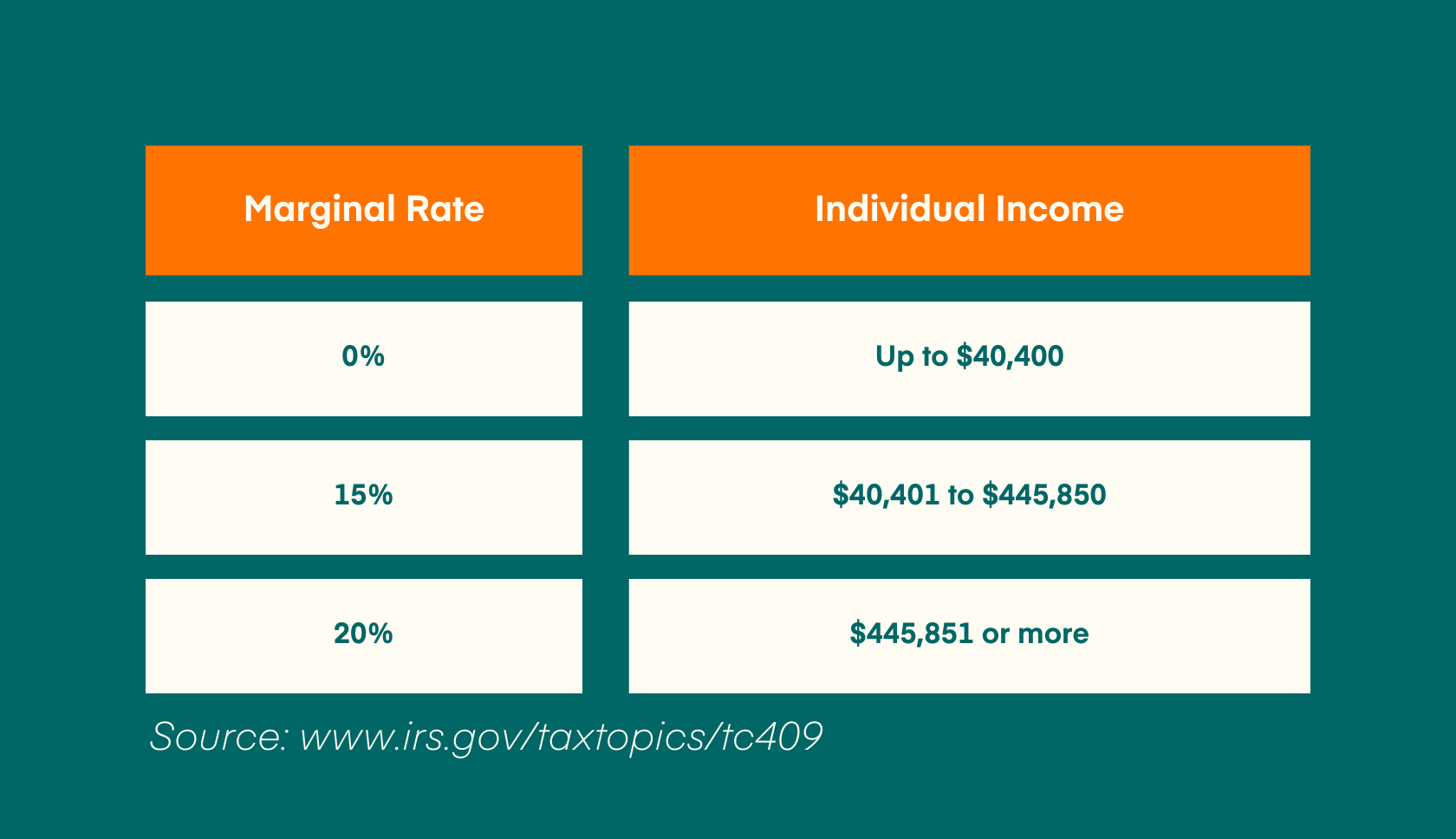

For long-term capital gains, federal tax rates are relatively lower:

Sample:

To demonstrate, we’ll compare short-term and long-term capital gains taxes with the same adjusted basis, net sales price, and individual income.

Short-term capital gain:

- Adjusted basis = $300,000

- Net sales price = $400,000

- Taxable gain = $100,000

- Individual income = $250,000 (35% bracket)

- Capital gains tax due = $35,000

Long-term capital gain:

- Adjusted basis = $300,000

- Net sales price = $400,000

- Taxable gain = $100,000

- Individual income = $250,000 (15% bracket)

- Capital gains tax due = $15,000

This example shows that short-term investors pay more tax on their capital gains than those with long-term investments. Yet, the good news for both parties is that there are ways to avoid capital gains tax on your rental properties altogether.

How to avoid capital gains tax?

Yes, as a real estate investor, you want to avoid facing any legal complications, which is why it is your duty to pay taxes to the government. That said, wouldn’t you want to know if there were ways to delay, reduce, or even avoid paying capital gains taxes legally? Well, there are. Here are some strategies you can use.

Use your asset as your primary residence

Converting your property into your primary residence can exclude up to $250,000 in taxable capital gains. This is according to Section 121 of the Internal Revenue Code, which states that investors can reduce capital gains tax by owning the property and using it as their primary residence for at least two of the five years before selling.

Several factors will come into play in determining the size of the deduction you’ll get. This includes depreciation recapture, qualified and non-qualified use, and the possibility of selling for a loss. Thus, it is best to seek assistance from your reliable tax advisor.

Tax-loss harvesting

The concept of tax-loss harvesting is selling a property at a loss to counterbalance the gains of another sold property at a profit. The condition is that the selling of both occurs in the same tax year.

This strategy helps reduce the cost of capital gains taxes while at the same time preserving the value of your portfolio. However, remember that the deduction can only be up to $3,000 net loss. The exceeding amount will be carried forward into the following tax year.

1031 tax-deferred exchange

Also known as the like-kind exchange, the Internal Revenue Code 1031 permits homeowners to sell a rental home and then buy another of the same or greater value while delaying the capital gain taxes. However, the 1031 tax-deferred exchange only applies to properties used for business or investment purposes. Therefore, primary residences do not qualify. Stocks and bonds are also not qualified in a Section 1031 exchange. Passed in December 2017, the Like-Kind Exchange Tax Treatment limits exchanges to real properties only.

An example of a like-kind exchange is selling your commercial property and then buying single-family rental homes. As you can notice, the “exchange” is not only between single-family homes or commercial properties. It can intertwine as long as the property is used for business or investment.

Retirement accounts

Retirement accounts like 401(k), IRA, and Roth IRA are tax-deferred. This means that, instead of paying upfront taxes like for capital gains, you’ll have the freedom not to up until you withdraw your funds. Your capital gains can then accumulate tax-free. Plus, should you decide to get your money after retiring, you can withdraw it at a lower tax bracket.

Avoid state-level capital gains tax rates

Aside from federal-level capital gains taxes, there are also taxes at the state level that you should consider. State-level capital gains taxes can range from 0% to 13.3%. Living and investing in those states that have no capital gains tax rate is a sure way to save some money overall. States like California (13.3%), New Jersey (10.75%), Washington DC (10.75%), Oregon (9.9%), and Minnesota (9.85%) have the highest capital gains taxes in the country. Meanwhile, Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, and Wyoming have no state capital gains tax at all.

Up next: Single-family rental loans

Final thoughts

Owning a rental property is indeed rewarding especially if the unit is performing well. But, when it’s time to call it quits and sell, you don’t want to lose a big cut of your profit down the drain by paying a significant amount of capital gains tax.

Fortunately, there are several strategies that you can use like the 1031 tax-deferred exchange and tax-loss harvesting to avoid, defer, or reduce the capital gains tax due. You may not have plans to sell your property now, but it pays to know your options when the time comes.

Recent Comments