Key takeaways

- Fix and flip loans are short-term solutions designed for buying, renovating, and selling properties for profit.

- Benefits include enhanced purchasing power, flexibility, and potential for higher returns.

- Loan types encompass hard money loans, bridge loans, HELOC, and private money loans.

- Common pitfalls to avoid include misjudging costs, overestimating property value after repair, choosing unsuitable loan types, and inadequate vetting of contractors.

The concept of fix and flip is straightforward – purchase a property at a lower price, renovate it, and then sell it for a profit. While the idea might sound simple, the execution requires planning, foresight, and, most importantly, capital. That’s when fix and flip loans come in handy. These financial tools enable investors to maximize their profits without tying up all their personal capital in a single project.

In this guide, we will dive deep into the world of fix and flip loans, unraveling their nuances and providing you with the essential knowledge you need to leverage them in your real estate endeavors.

What are fix and flip loans?

Fix and flip loans are short-term financial solutions tailored for real estate investors who focus on property purchase, renovation, and resale. These loans stand apart from traditional mortgages, which may not provide the swift funding that property flippers often need. Their duration typically spans from a few months to several years, aligning with the time taken to transform and resell a property. Despite their expedited access to funds, they often come with higher interest rates than standard mortgages, reflecting the inherent risks of property flipping. Furthermore, lenders usually mandate a comprehensive plan detailing how borrowers will allocate the loan, from property acquisition to specific renovation steps.

When comparing them to traditional mortgages, several distinctions emerge. Fix and flip loans are generally short-lived, contrasting with the decades-long lifespan of conventional mortgages. Their approval process is notably quicker, often taking just days compared to the protracted timelines of standard mortgage approvals. The collateral for these loans hinges on the property’s estimated value post-renovation (referred to as the After Repair Value or ARV), whereas traditional mortgages are anchored to the property’s existing value. Additionally, the nature of these loans means lenders tend to offer more flexibility in fund utilization, provided it aligns with the outlined renovation objectives.

How fix and flip loans help investors

Embarking on a fix-and-flip project is exciting, but it’s also financially demanding. The sheer costs of purchasing properties, undertaking extensive renovations, and then managing holding costs can make the venture daunting for many. Furthermore, fixing and flipping homes require speed and flexibility when it comes to capital. This is where fix-and-flip loans can come in handy, providing the crucial financial scaffolding that supports the aspirations of real estate flippers.

Some advantages of using fix-and-flip loans include:

- Increased purchasing power

- Preservation of personal capital

- Flexibility in project choices

- Potentially higher returns

Types of fix and flip loans

There are a plethora of options tailored to cater to the unique needs of property flippers. While each loan type has distinct features and advantages, a comprehensive understanding of their nuances can guide investors in making the right financing choices for their projects.

Hard money loans

Hard money loans are essentially asset-based loans facilitated by private lenders (sometimes called asset lenders or rehab lenders). Their primary security is the property’s value, with emphasis often placed on its After Repair Value (ARV). One of the significant attractions of hard money loans is the speed of approval and disbursement. This makes them particularly suited for investors who need swift financing, especially those with credit scores that might fail to pass traditional banks.

However, this convenience comes at a price—these loans typically have higher interest rates (usually 10-18%) than conventional loans and come with a shorter repayment window. Despite the costs, they are perfect for new investors who might not qualify for traditional financing or are looking for quick capital.

Bridge loans

As the name suggests, bridge loans serve to bridge the financial gap. They are short-term financing options designed specifically for those intervals between the acquisition of a new property and the sale of an existing one.

Investors who chance upon a lucrative property but are still waiting on the sale of a previous investment will find bridge loans immensely valuable. They provide the necessary financial cushion, allowing flippers to seize emerging opportunities without being constrained by the liquidity timeline of their existing assets.

Home Equity Line of Credit (HELOC)

A HELOC offers a revolving line of credit, granting borrowers access to funds by leveraging the equity in their primary residence. It’s akin to a credit card but backed by the value of one’s home. A notable advantage of HELOCs is their relatively low interest rates, especially when compared to hard money loans. This financing option also offers the flexibility of drawing and repaying funds as and when the need arises.

However, there are intrinsic risks such that the borrower’s residence is on the line, and should there be any default, they stand to lose their home. Furthermore, some HELOCs come with variable interest rates, which could escalate over time, and the approval process might be lengthier than other fix-and-flip financing options.

Private money loans

Distinct from institutionalized lending avenues, private money loans originate from individuals or small groups investing their personal funds. Think of it as a loan from close family and friends to business associates or acquaintances.

The core of such lending relationships is trust. For investors considering this route, open communication is vital. Being transparent about project plans, potential risks, and expected returns can cultivate and reinforce trust. Moreover, a demonstrated history of successful flips can be the calling card that secures such beneficial relationships.

Recommended: Build-to-rent investment: Your complete guide

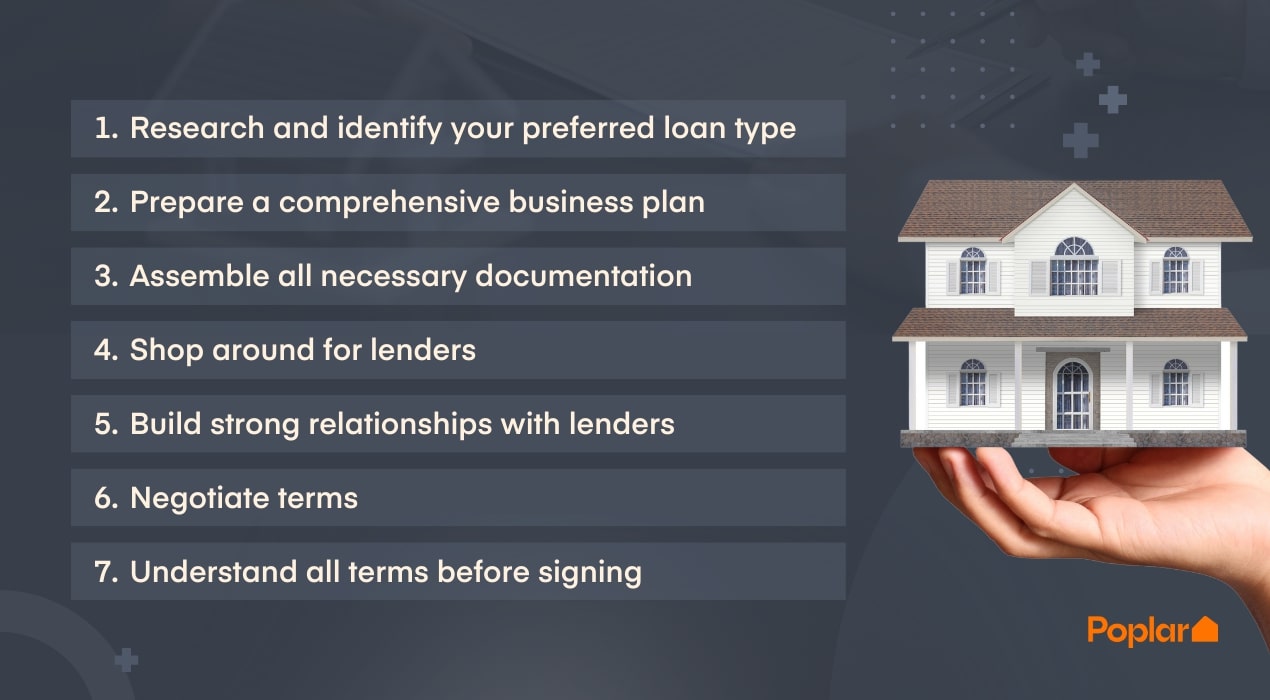

How to secure a Fix and Flip Loan

Now that we’ve discussed what fix and flip loans are, as well as the types of loans available, let’s discuss how to secure a fix and flip loan:

1. Research and identify your preferred loan type

Before approaching any lender, do thorough research to determine which type of loan aligns best with your needs. Are you looking for a quick financing solution for your first deal? Hard money lenders may be more lenient in offering you a loan. Do you have the equity to back up a HELOC? It may prove useful when you need flexibility in drawing and repaying funds come renovation time.

The clearer you are about your requirements, the smoother your loan application process will be.

2. Prepare a comprehensive business plan

Lenders are more inclined to offer loans to those who can display a clear and carefully planned business plan. This plan should detail the property’s purchase price, estimated repair costs, ARV, expected market time, and your exit strategy.

3. Assemble all necessary documentation

Having your documentation ready can expedite the loan process. This typically includes:

- Proof of income

- Credit report

- Personal identification

- Record of past flips (if any)

- Contractor bids for renovation (if applicable)

- Comparative market analysis or property appraisals

4. Shop around for lenders

It’s wise not to settle for the first lender you approach. Shopping around and comparing terms, interest rates, and other costs can help you secure the most favorable deal.

One of the best ways to search for options is a quick Google search of fix and flip loans in your area. Often, you get sponsored ads from the top companies licensed in your jurisdiction that could offer you great deals. You can also ask your friends and family for recommendations or if they are interested in doing a private deal with you.

5. Build strong relationships with lenders

Foster relationships with lenders to increase your chances of securing a loan and potentially better terms in the future. Many lenders value trust and reliability, and if you repay your loans on time and maintain open communication, they are more likely to assist you in subsequent projects.

6. Negotiate terms

Don’t hesitate to negotiate the terms of your loan. This can include interest rates, loan duration, early repayment penalties, or other fees. Demonstrating knowledge about the industry can place you in a good position during negotiations.

7. Understand all terms before signing

Before committing to any loan, ensure that you fully understand all the terms and conditions. If there are clauses you’re uncertain about, consider consulting with a financial advisor or attorney.

Common mistakes to avoid in fix and flip ventures

While securing a fix and flip loan is crucial, understanding the frequent pitfalls in the process can be just as vital for success.

Here’s a rundown of key missteps to watch out for:

1. Underestimating repair costs

One of the most frequent pitfalls in the flipping business is not accurately gauging renovation expenses. This can lead to budget overruns, making projects financially unviable. Always account for contingencies and unexpected costs.

2. Overestimating ARV

Being overly optimistic about the After Repair Value (ARV) can result in losses if the property sells for a different price. It’s essential to conduct thorough market research and seek expert opinions to set realistic expectations.

3. Choosing the wrong loan type

Different projects have varying financial needs. Opting for a loan type that aligns differently from your project’s requirements can lead to financial strain. Analyze the terms, interest rates, and duration to ensure they match your flipping strategy.

4. Not vetting contractors or other team members

Your team’s proficiency can make or break your flip project. Cutting corners by not thoroughly checking the credentials and references of contractors and other team members can lead to subpar work, legal issues, or cost overruns. Always prioritize quality and reliability when building your team.

Up next: Rental property ROI: What homeowners need to know

Final thoughts

Venturing into fix and flip real estate is both challenging and rewarding. Proper financing, through tools like fix and flip loans, bridges the gap between aspiration and execution. For those new to the field, understanding available types of loans is essential. Always approach financing decisions with research, seek expert advice when needed, and stay focused on your overall goals. With the right knowledge and financial strategy, fixing and flipping can be a lucrative endeavor.

Recent Comments