It’s no secret that demand for housing has skyrocketed in recent months, despite slow economic growth after a pandemic-induced crisis. But the number of homes in the market has plummeted, further driving the demand and increasing home prices.

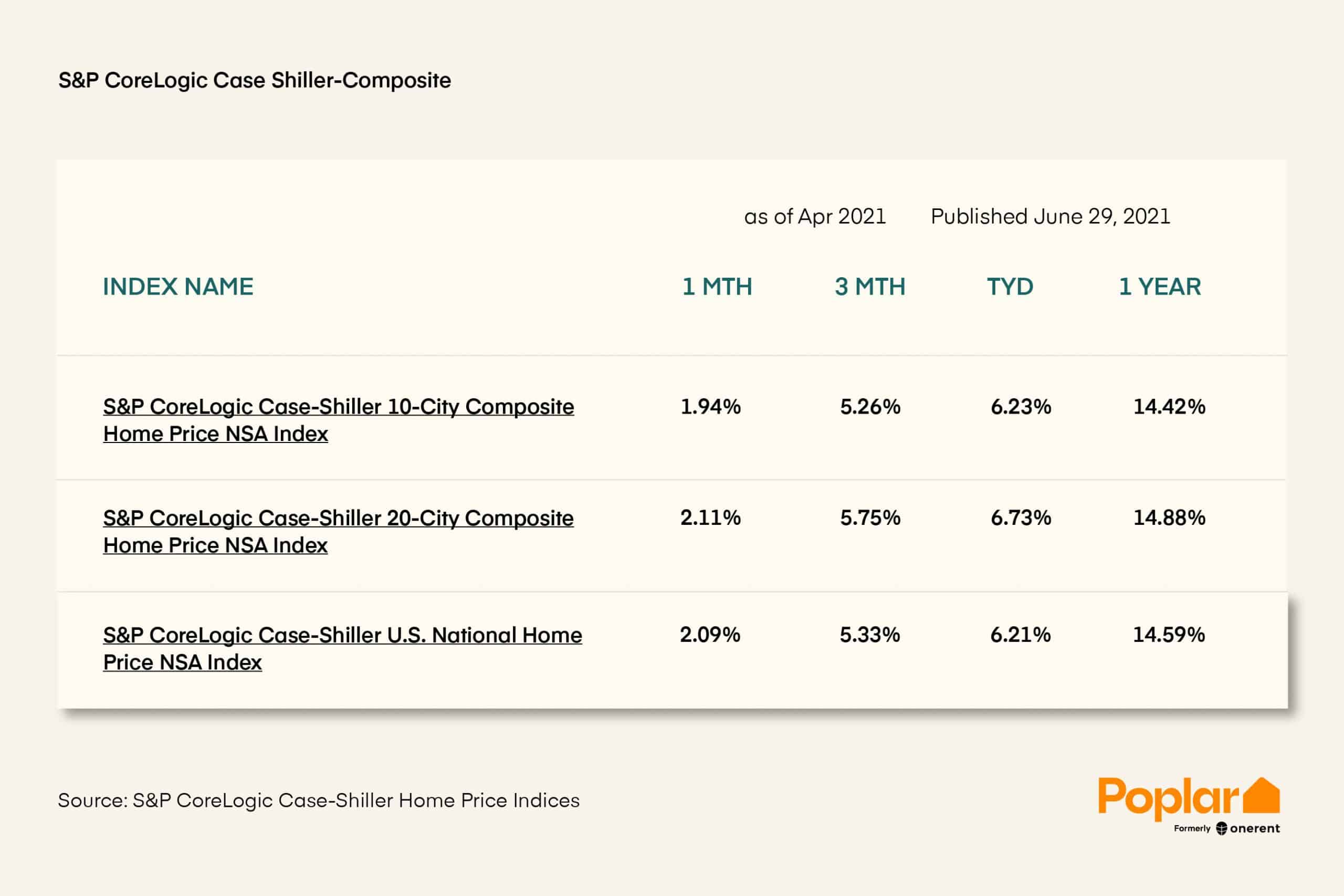

As of April this year, home prices have surged to a 14.59% increase from year-ago levels, averaging at $293,394. Despite such high prices, homes sell quickly at an average of 43 days upon listing.

The S&P CoreLogic Case-Shiller Home Price Indices are the leading measures of U.S. residential real estate prices, tracking changes in the value of residential real estate nationally.

Let’s take a look at three factors that contributed to the low supply that made the housing market red-hot at the moment, and how homeowners can take advantage of it.

The Pandemic Saw Lesser Homes on the Market

When the federal government enforced shelter-in-place orders and movement restrictions to limit the spread of coronavirus, owners selling their homes took their listings off the market to avoid people visiting their properties and risking infection.

People were also sent home to work remotely, making the work-from-home setup part of the new normal. Homeowners planning to sell their properties, especially those with large spaces, reconsidered keeping them engaged or staying in the rental business.

Lack of New Homes Contributed to the Housing Crisis

A report by the National Association of Realtors indicated that the years-long lack of new construction and prolonged underinvestment in new housing is causing a serious housing crisis. Housing inventory grew at a much slower pace, causing an “underbuilding gap” of 5.5 to 6.8 million housing units since 2001.

NAR’s chief economist Lawrence Yun said that while Americans desire homeownership, they are unable to achieve that dream because of lack of supply. An Urban Institute study revealed that homeownership rate is predicted to decline to 62% in the next 20 years if no positive actions are taken to address the housing shortage.

Low Mortgage Rates Encourage People to Buy

As of July this year, the average fixed-rate mortgage is at 2.88%, a level the federal government plans to keep until 2022. This low mortgage rate is intended to promote confidence in the housing market among first-time homebuyers and those who want to buy another property. It’s also meant to incentivize institutional investors who buy single-family homes and turn them into rental properties. Spurred by low mortgage rates, more people snap up homes on the market, further dwindling supply.

Homeowners Can Leverage the Rising Home Prices

As a homeowner, your response to the increased demand in the housing market would largely depend on your current needs. Of course, you can decide to keep your home as part of an estate that you might want to pass on to your family or relatives. But if you decide to sell and cash in for a profit or, better yet, buy to increase your portfolio, here are a few things to consider.

Selling Your Home

If the current conditions hold, now would be a good time to sell. With so many buyers on the lookout for a property, you are in the best position to command higher prices. But whether you plan to relocate, downsize to a smaller home, or just need the money, decide carefully why you want to sell.

If you’re selling to upgrade to a bigger and more expensive home, even with a low mortgage rate, it may cost you more money in the long run. That’s because the cost of maintaining a bigger home adds up—taxes, mortgage insurance, homeowners insurance, and homeowner association fees are just some of the costs.

Here are signs that will tell if you’re ready to sell:

- You have enough equity on your home that the proceeds from selling it can pay off your mortgage and the 20% down payment on the next home you plan to buy.

- You’re financially stable with no debts in tow. This means you can support the mortgage payments of a new home.

- You can afford the cost of moving and living in a new home.

- You’re up to the work involved in selling your home, such as staging, showings, screening buyers, filing paperwork, and moving out.

Buying a New Home

Granted that you’ll find enough inventory to make a good selection, low mortgage rates can indicate a good time to buy a house. One of the best reasons to buy is to invest in a rental property to create passive income. Those already in the business can consider buying another property to expand their portfolio.

The current market is fast-paced, and having a goal will help you narrow down your choices and make quick buying decisions.

Here are good indicators that tell if you’re ready to buy at this time:

- You’re willing to bid and pay above the asking price.

- Your finances allow you to pay in cash.

- Your working condition is not location-dependent and you’re fine moving to a lower cost home.

- You’re open to settling with a distressed property that may require a bit of work to make it habitable, and can afford it.

When you bid for a property, understand that you are not only competing with individual homebuyers but also with investors. Twenty percent of single-family home sales in 2020 came from institutional investors, outbidding cash offers from individual buyers by six times. So working with a real estate agent with years of tactical experience in fast-paced real estate transactions is your best bet. They are in the best position to negotiate on your behalf.

Related Read: First Time Buying a Home? Here’s an 8-Step Guide You Need to Know

Getting Help from Poplar

If you are serious about taking advantage of the current housing demand by buying or selling your property, you’ll be glad to know that Poplar Homes can assist you, banking on our large network of homeowners who may want to sell, and renters who may want to buy.

We even help our renters save money towards a future home purchase through our product called StreetCred. Poplar StreetCred lets renters earn credits equivalent to 20% of their monthly rent which they can use to pay off fees associated with a future home purchase.

Keeping Your Home

If you do not want to either buy or sell at this time, keeping your home can also give you some financial advantages.

Cancel Your PMI to Save Money

Private Mortgage Insurance (PMI) is a standard requirement for a conventional mortgage loan to protect your lender in case you stop making loan payments. You can only ask your insurer to drop this insurance when you have paid your mortgage balance down to about 80% of your home’s original appraised value. Considering how long that period is, and with PMI costing you an extra $100 to $300 a month, that sums up to a lot of money.

But if your home is now worth more than when you bought it, then you may already hold enough equity and are no longer considered as a high-risk borrower. In this case, you may request your insurer to cancel your insurance. All you need to do is have your home appraised to determine how much it has increased in value and provide documents that support this to your insurer.

Borrow Money Against Your Equity

Another way you can leverage your equity is to borrow money against it. You can use your equity to apply for a home equity loan or a line of credit. You can use the money to make home renovations, car repairs, travel, or fund an education.

Conclusion

A good opportunity awaits you at this time whether you plan to buy or sell your home. But navigating the current market by yourself may lead to making the wrong moves. Don’t think twice about working with a professional real estate agent to help you. They are your best bet for having a more strategic approach in the whole buying and selling process, and for ensuring that you make the best possible decision to achieve your investment or personal goals.

Recent Comments