You put in countless hours and the best of you into your property management company, so it only makes sense that you want to get the best value for it. But what should you do to prepare for selling your business?

Here are some tips that can help strengthen your exit strategy

Understand why your want to sell

Worn out from all the property management work? Want to kick your feet up and enjoy retirement? Or are you simply looking for a fresh start? Whatever your reason is, it’s always good to know so you can plot your next steps wisely.

Whether you’re looking for a clean break or still want to be around but on a smaller scale, knowing so will help you strategize towards getting a deal you’ll be happy with.

Sell at the right time

Best to plan an exit strategy early on, whether you intend to sell in the future or not. Increase your awareness of what’s going on in the market by having conversations with contemporaries and leaders in the industry.

It pays to have the knowledge and insight early in the game to better position yourself when you finally decide to sell your business. You don’t want to put your company on the market unprepared when things get tough in your business. Doing that won’t give you the best value for your business.

Selling your portfolio when it’s well-occupied and stable is likely your best choice. The prospect of better homeowner conversion makes it more attractive to the new management, giving you higher chances for a better deal.

See who’s buying

When choosing a buyer for your business, do your homework. Research the different types of buyers so you can make an informed choice about who to sell to. Industry buyers are naturally more established than others, and more likely to offer you terms like keeping your staff and even having you on board as a consultant, depending on how involved in the business you want to be. Here are the different types of potential buyers that you might encounter.

A connection

You know this buyer well-It could be a relative, friend, or even a trusted employee.

Typically, it is difficult for connected buyers to pay a premium. Still, if you do not need immediate cash and want a smooth transition, working with a connection can work in your favor.

A competitor

Selling your business to your local competitor is a viable option.

It’s a challenge to merge the operations of two businesses, but on the flip side, you both get to maintain community relations with ease.

A cash-flow buyer

If cash-strapped, selling to a private equity company is your best bet.

Your team may have a rough transition, but these buyers can afford to pay a premium for your business.

An industry buyer

Industry buyers not only pay competitive prices but also reward you with better returns.

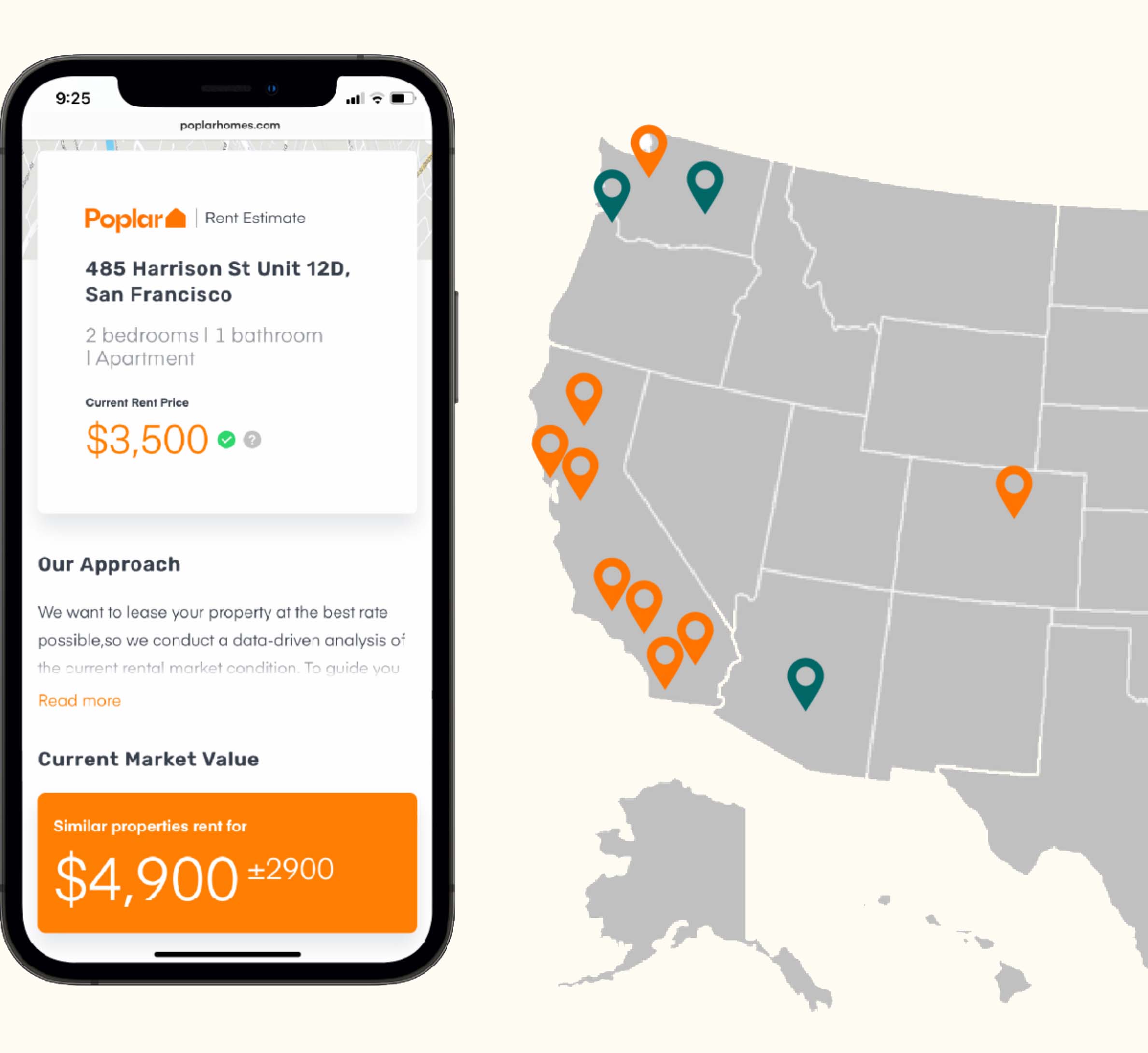

Financial gain for you and long-term benefits for your employees go hand-in-hand if you sell to an industry buyer like Poplar Homes.

Industry buyers like Poplar Homes have the insight, expertise, and technology to grow your business after acquisition. If you made a clean break with your business, seeing it scale up can give you a sense of pride in having started it. If you’re still on board the team, it will give you a sense of satisfaction in being part of its growth.

Know your business’ value early on

Determining the true value of your business is crucial. Talk to people who can help you understand what your business is worth. See what others are paying for a business similar to yours. Make sure you do a proper valuation of your business to gain the attention of investors and buyers.

Knowing the right value of your business will make it possible for you to do what you want post-exit, whether it’s to enjoy retirement with your family or finance a new venture you’ve been itching to launch.

Recent Comments