Happy day! If you’re reading this post, you might already have a hint about the big shifts in the real estate industry. These shifts are predicted to impact renters on the way they search for rental homes, first-time homebuyers on how they buy a home, and homeowners on their property investments. And we are stepping up to be a key player in these changes.

So, today we’re going to dive into the specifics but before we get started on that, let’s do a quick throwback.

We, Chuck Hattemer, Greg Tosci, and Rico Mok, founded Poplar Homes six years ago. Since then, Poplar Homes has helped 7,100+ homeowners to maintain their properties’ upkeep, save costs, increase rental income, and expand their portfolios. We’ve also helped 50,000+ renters find a home and live safely and comfortably.

All thanks to our customers — rental owners and renters — that allowed us to show how technology can turn a painful rental process into a seamless and hassle-free experience. And with the big changes in the industry and their impact on you, we’re leveling up our services with our customers’ best interest as our priority.

As we aim to become our customers’ real estate lifetime partner, we will expand our services to include homeownership. Our goal is to assist homeowners and renters beyond renting, to free them from the hassles of renting, and empower them to become successful in real estate. This change will come soon, so stay tuned as we keep you updated on the latest developments.

Okay, now on to the big shifts in the real estate industry.

Rental vacancies are running short due to high demand driven by lifestyle change

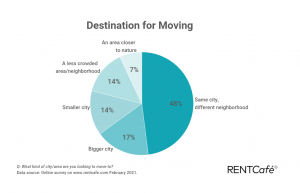

The pandemic was a game-changer for renters to make lifestyle improvements. Workforces are adapting so well to work-from-home setups that it’s likely to continue post-pandemic. A recent research with 10,000 respondents showed that 20% of renters currently living in small spaces are now considering relocating to bigger spaces, while 48% are planning to relocate in the same city but with better housing conditions.

Image Source: www.azbigmedia.com

But there aren’t enough rental vacancies in the market to make a good selection. The eviction moratorium allowed renters to continue to occupy their homes even when they could no longer pay their rent. Likewise, strict health protocols limit renters from personally viewing a property they’re interested in. It’s no wonder they struggle to find a home they like during these times.

Enter the Poplar Homes technology. The pandemic has set the stage for Poplar Homes’ seamless, convenient, and most importantly, contactless rental process that is truly ahead of its time. For instance . . .

Poplar Homes’ listings offer more homes in more locations– accessible anytime and anywhere

Renters seeking a new rental home either due to relocation to a more quiet neighborhood, or to a bigger space for a more efficient work-from-home set up, may find it a bit of a struggle to look for a place even if they can afford the upswing in rent prices.

This is because the eviction moratorium has disrupted the natural course of the eviction cycle. Homes that would normally be vacated and made available to the market because of evictions, still remain occupied and will continue to be so if the moratorium period extends beyond its June 30, 2021 due date.

Here is where Poplar Homes’ tech system comes into play. Our tech allows renters to easily find hundreds of listings in different cities on the West Coast, and soon in the rest of the US. The effortless navigation gives you easy access and allows you to make property inquiries on any home you like.

Poplar Homes makes property viewing easy and convenient for renters

The heavy restrictions of the pandemic — shelter in place, limited movement, and social distancing — have made it more difficult for renters to view a home located in different places.

With Poplar Homes’ contactless rental process, you can safely check on multiple rental homes without leaving your place. You can easily see the appealing home features with quality images of our listings and use tools like our 3D Virtual Tours. This will save you a huge amount of time and effort.

Poplar Homes helps renters find a home that fits their budget

Because there are fewer rental homes available in the market as a result of the eviction moratorium, it created a demand among seekers, hence the sizable increase in rent prices. During a pandemic, it’s not something most renters are ready for even if looking for a place to live is part of their permanent plan.

Once the eviction moratorium ends, a lot of homes will be vacated and made available to the market. The increased vacancy rate will eventually bring down rent prices.

Poplar Homes makes sure each property on the list is priced based on fair market pricing. We use our proprietary formula that comes up with a rent price that gets the most traction in today’s rental market.

We want tenancy to be always a win-win situation for both owner and renter. On our platform, renters can even find properties that are offered with huge discounts so it’s a good time to take advantage of that.

First-time homebuyers have weaker purchasing power due to more competition and higher housing prices

Today’s challenging market is unfavorable for first-time homebuyers to snap a home due to high prices, slender stock of home listing, and more competition.

The latest data shows an 18.4% increase in home prices from March 2020. Housing inventory is down by 28.2%, and homes are selling as fast as 2.1 months. If you’ve watched Mortgage or Marriage, Nichole Homes said, “Sometimes the houses would sell before we ever got a chance to look at them.”

But don’t lose hope. As we step up in the real estate industry, we offer first-time homebuyers the opportunity to own a home with Poplar StreetCred.

Poplar StreetCred helps renters afford the home they deserve

Poplar Homes understands the pain and weight of buying a home for the first time. We’re here to revolutionize real estate and improve the lives of our customers through insight-driven innovation, providing a stress-free, painless real estate experience.

With Poplar StreetCred, we give our renters 20% of their monthly rental payment back as credit that they can use for a future home purchase. This will not only help renters buy a home sooner, it will also address the affordability issue in buying a home.

Home selling becomes more favorable to sellers than homebuyers

As mentioned above, today’s housing trends aren’t favorable to first-time home buyers. Fortunately, data from Realtor.com shows a 40% gain for new home listings in the first week of April 2021. While this is a good sign that more supply is coming, the housing inventory is still very low and may take time to recover.

This means the biggest hurdles homebuyers will face this year will be the lack of housing inventory and affordability.

To ease your stress of purchasing a home in today’s demanding housing market, here are some practical tips you can follow.

Ask the right questions and know your rights

Before buying a home, educate yourself on the many aspects involved in the home buying process so you can make wise decisions. This is especially important before engaging in any loan agreement.

Some questions to ask yourself before purchasing a home include:

“Do I need a real estate agent?”

“What are the associated fees in buying a home?

“How do I get the best interest rates?”

“How do I avoid paying fees upfront?”

As a first-time home buyer, you also need to know your rights. According to the US Department of Housing and Urban Development, you have the right to:

- Shop and compare rates of several lenders

- Be informed of your total loan cost including your interest rates, fees, and points

- Ask any questions about loan terms, charges, and fees that you don’t understand

- Receive fair credit decisions regardless of your race, color, sex, marital status, age, and religion

- Know why your loan wasn’t approved

Look for the right mortgage lender and learn the mortgage rules

When searching for a credible mortgage lender, start by asking trusted family members and friends. Contact the lender and inform them of your interest in buying your first home. Get to know them. The right mortgage lender is patient, helpful, and knowledgeable. This will give you confidence when making a purchase.

It’s also important to learn mortgage rules to protect yourself from any form of financial loss. The Consumer Financial Protection Bureau has implemented new rules for borrowers if you ever run into problems with your mortgage service provider. The full document containing the mortgage rules is found here.

Set a realistic budget according to your current financial situation

Knowing how much you can afford is vital in buying your first home. It allows you to scout listings that are within the range of your budget, helping you save time and effort.

When setting a budget, Investopedia recommends using the 28/36 rule–spend a maximum of 28% of your monthly income for your housing expenses and 36% for your debt services.

Say your income is $5,000 per month. Your monthly housing expenses including mortgage payments, property taxes, and insurance, should not exceed $1,400, and your monthly debt payment should not be more than $1,800. These represent 28% and 36%, respectively, of your monthly income.

Lenders often use the 28/36 rule when assessing your loan application. Hence, it’s best to deal with your other debts such as car loans and credit cards and build your credit score before buying your first home.

Process your thoughts well before making a decision

Purchasing a home is a big decision. Avoid making a mistake by being emotional or impatient. It helps to seek sound advice from people you trust such as your family, friends, and real estate professionals. After receiving counsel, be sure to weigh your options based on what you want.

Be patient and mindful when deciding to use a real estate agent, choosing the right mortgage broker, setting your budget, and viewing property listings. Take enough time to review all of your options so you’ll have an informed and wise decision.

Conclusion

Big shifts like the ones mentioned above are inevitable in the industry. But it’s our mission to always rise above and be bigger than these obstacles. Innovation, enabled by insight, is the roaring engine of our brand.

Real estate is a life-long journey, and no matter where our customers are, we’re here to help. This is why we’re stepping up in the real estate industry to provide the most innovative, seamless, accessible, and friendly real estate experience. We aim to be our customer’s lifetime real estate partner, from renting to buying and beyond.

With these, we have big news coming soon. Stay tuned!

Recent Comments